To be clear, the world has far greater challenges right now than the price of bicycles.

However, with US tariffs and ‘reciprocal tariffs’ sending global financial markets into a nosedive and a deeply uncertain outlook for all manner of consumer goods and raw materials, it’s fair to say the already-struggling cycling industry could be facing an even grimmer ride in the coming months, if not years.

Our news media is awash with commentary on the subject, and many are speculating about what will happen next. Our banks tend to err on the side of conservative approaches, so it’s concerning when they suggest a US recession might be on its way.

Brian Martin, Head of G3 Economics at ANZ, said in a report released by the bank, “Following President Trump’s tariff announcements on 2 April, US recession risks have escalated. The speed and magnitude of the sell-off in stock markets and associated inversion of the US yield curve reflects intensified anxiety about rising prices, falling demand and supply-chain disruptions. Economic uncertainty has jumped, and that too can lead to reduced household consumption and business investment. Whether the 2 April tariff announcements act as leverage to force more open international trade relations or become permanent is a source of much uncertainty at present.”

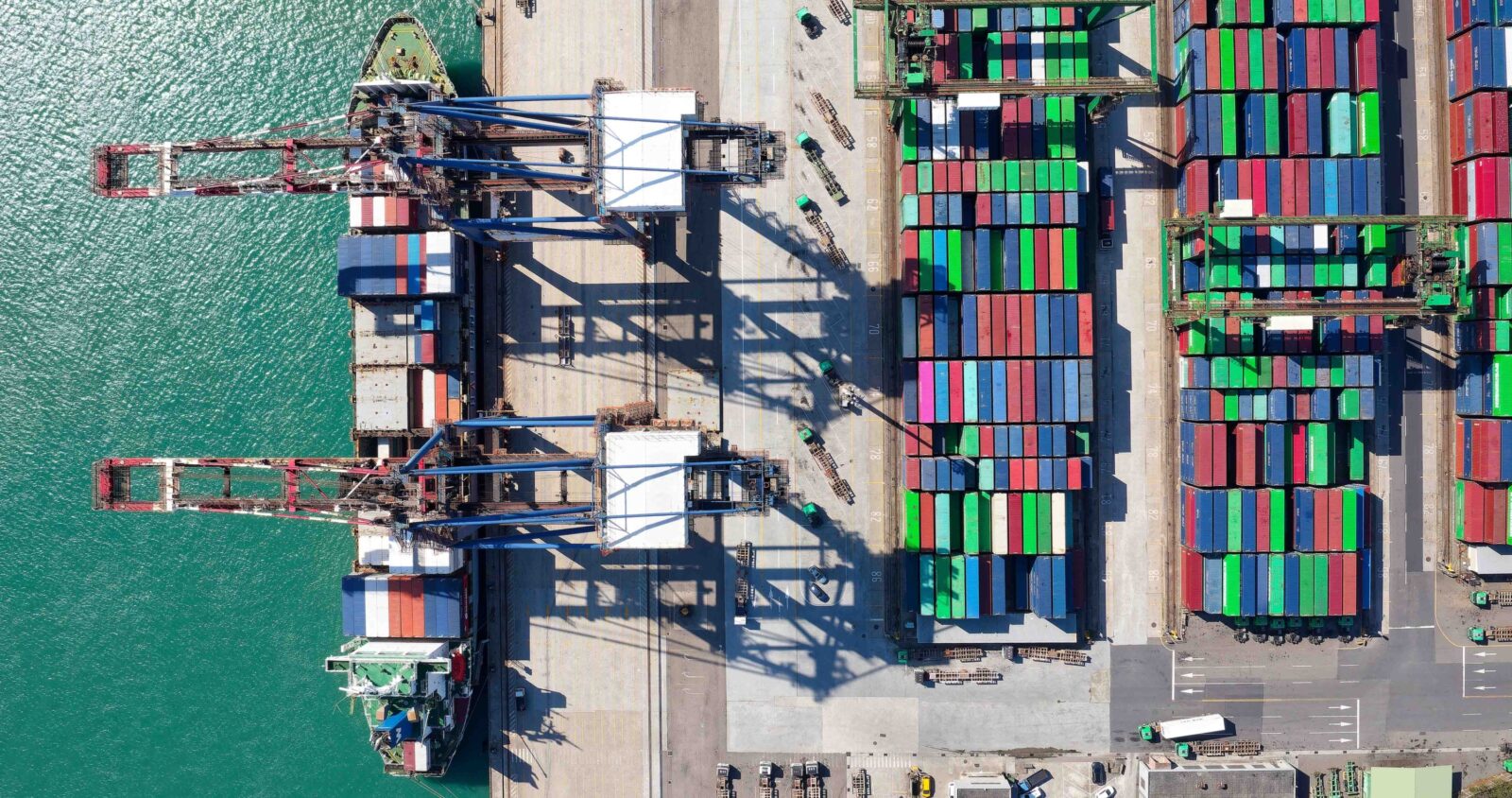

Depending on who you ask, the international bicycle industry is estimated to be worth around US$60 billion. Of this, North America represents nearly a third. That’s a significant slice of the global market and any recalibrations to the manufacturing and supply chains required to service it are likely to have seismic consequences, especially when you consider nations like China, Taiwan, Cambodia, Vietnam and Indonesia provide well over 90% of the USA’s cycling imports (Source: Bicycle Retailer & Industry News) and are all subject to major new import tariffs. The threat looms as existential for countless businesses and brands, especially those based in cycling’s long-time manufacturing epicentres across Asia.

Now, as we all know, bikes and their associated products are made from lots of different materials and components from lots of different places. That makes things pretty complicated. Even if USA-based manufacturing and assembly facilities were to quickly emerge – which is a huge ‘if’ of course – many of the highly specialised components required to compete the process would still be subject to the recently-announced tariffs and, therefore, still put upward pressure on prices, further straining an industry that’s still trying to rebalance from its post-COVID hangover.

At a time when industry pricing was already firmly in the crosshairs, can cycling sustain further increases? Will manufacturers accept lower margins in an attempt to cushion some (if not all) of the tariff impact? Will consumer demand collapse? Will suppliers fold under the crippling weight of added cashflow pressure? Will sponsors disappear? Will new North American manufacturers emerge to provide credible alternatives? Who knows. But even if they do, it certainly won’t happen overnight. After all, you can’t merely click your fingers and magically start producing large volumes of world-class cycling products. IP and expertise developed over decades and generations in Taichung in Taiwan, for example, isn’t instantly transferrable across the North Pacific just because a political leader signed a piece of paper in a Washington DC rose garden.

With all this uncertainty, we asked a few industry people to comment on the situation, and while a few declined to be involved, we did catch up with those willing to go on the record.

Industry veteran and founder of this publication, Phil Latz, responded to our question about the effect of tariff changes on the Australian bicycle industry, saying, “I don’t think there will be a major impact in the short to medium term.”

“Prices won’t necessarily rise because none of the bikes sold in Australia go through the US. Most come from China, Taiwan or other Asian countries. Although, the longer-term potential for a global recession could have an impact.”

Matt Whitmore from distributor CTN Imports agreed that any impact is indirect and said he’s more concerned about the weakening of the Australian dollar (AUD).

“Between a volatile AUD, rising manufacturing and logistics costs, and the potential redirection of global supply chains, prices are very likely to rise. Retailers and importers are already working with thin margins, and there’s only so much cost absorption that can occur before those increases reach consumers.

“However, I believe the price increases will also accelerate consumer awareness. More cyclists are shopping smart, they’re actively comparing specs, materials, and value. It’s not just about price; it’s about getting more for your money.

“As a distributor that represents multiple cycling brands in Australia and New Zealand, we’re already seeing upward cost pressure from international suppliers and freight. While the US market changes don’t hit us directly, the ripple effects, especially around pricing sensitivity, are being felt,” added Whitmore.

Storm clouds are gathering. Failing some last-minute policy pirouette (always possible under the current administration, of course), it may take a little while for the full impact to reach the retail front lines here in Australia. But reach us it most likely will.

What happens then is anyone’s guess.